snohomish property tax payment

Offered by County of Snohomish Washington. If youre a homeowner youll have to pay property taxes each year.

Snohomish County Treasurer Payments

With an average tax rate of 089 Snohomish County residents pay an average of 3009 a year in property taxes.

. Whatcom County sits in the northeast corner of Washington State along the Canadian Border. The median annual property tax payment in the county is just 1768. Snohomish and every other in-county public taxing unit can now calculate needed tax rates since market value totals have been determined.

If you pay the first half of your taxes by April 30th but fail to pay the second half by October 31st the unpaid portion is subject to 1 interest per month. Median Property Taxes No Mortgage 3534. Payments Due First half or full payment of real estate taxes is due April 30 second half taxes are due by October 31.

Is the service provider for the Snohomish County EBPP Electronic Bill Presentment. Precisely how much you have to pay will vary depending on where you live and the value of. In this mainly budgetary function county and local public leaders estimate annual spending.

Value by the corresponding tax rates and is an estimate of what an owner not benefiting from any exemptions would pay. Email the Personal Property Division. In case you missed it the link opens in a new tab of your browser.

The median property tax in Snohomish County Washington is 3009 per year for a home worth the median value of 338600. When summed up the property tax burden all owners shoulder is created. View your online tax statement.

When paying by mail payments must be postmarked no later than the due date or the taxes become delinquent. 2022 Point Pay. 425-262-2469 Personal Property.

The following links maybe helpful. 05734 72701. Sign up for PAPERLESS BILLING for future tax statements.

Pay for services online. Interest continues to accrue until the taxes are paid in full. Make one time payments eCheck or credit card.

Snohomish County collects on average 089 of a propertys assessed fair market value as property tax. These are all other RESERVE auctions. Ad Need Property Records For Properties In Snohomish County.

Research legal forms or comment in coordination or investments based upon payment is just taxes online county property payment relief proposals that the combined sales. Call us toll-free 24-hours a day to make a fast and easy payment. Please have your bill and bank or credit card information ready when you call.

Snohomish County Treasurer Payments. Point Pay Support. Tax description Assessed value Millage rate Tax amount.

Monthly Collection Services Snohomish County Property Taxes 012319 Snohomish County Property Tax Payment Program Fee Schedule Account Setup Fee 7500 Monthly Account Processing Fee 1500 Phone Payment Fee 2000 NSF Fee 3500 Early Termination Fee 3500. Visa and Mastercard creditdebit card check Prepaid credit cards are not accepted. The Assessor and the Treasurer use the same software to record the value and the taxes due.

If your taxes are still delinquent on June 1st you are subject to a 3 penalty. The Property Tax Annual Cycle in Washington State MyTicor COVID 19 Response and Resources Snohomish County 06022021 Tax Payment Options Snohomish County. Scan Snohomish County Property Records for the Real Estate Info You Need.

Median Property Taxes Mortgage 3638. Make a one time payment below using your Parcel ID OR use the Create an account link to make future payments easier. Snohomish County has one of the highest median property taxes in the United States and is ranked 155th of the 3143 counties in order of.

New Functionality for 2016- SEE YOUR TAX STATEMENT ONLINE. It has property tax rates well below the state average. The Whatcom County average effective property tax rate is 085 compared to the Washington State average of 093.

In-depth Snohomish County WA Property Tax Information. Pay the county now. Use the search tool above to locate your property summary or pay your taxes online.

Underscore may be available to real id scanning for snohomish county property tax payment online tools with our citizens with food. Personal Property Appraisal Process PDF Advance Tax Business Closure. Snohomish County Property Tax Payments Annual Snohomish County Washington.

The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information. Advance Tax Move Out of County.

Snohomish County Voting Today To Determine The Future Of Property Tax Levies

About Efile Snohomish County Wa Official Website

Tax Payment Options Snohomish County Wa Official Website

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

How To Read Your Property Tax Statement Snohomish County Wa Official Website

By The Numbers Largest Taxpayers In Snohomish County Heraldnet Com

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

Pin By The Platz Group On Homes For Sale In Snohomish County Marble Tile Floor Corner Fireplace Outdoor Decor

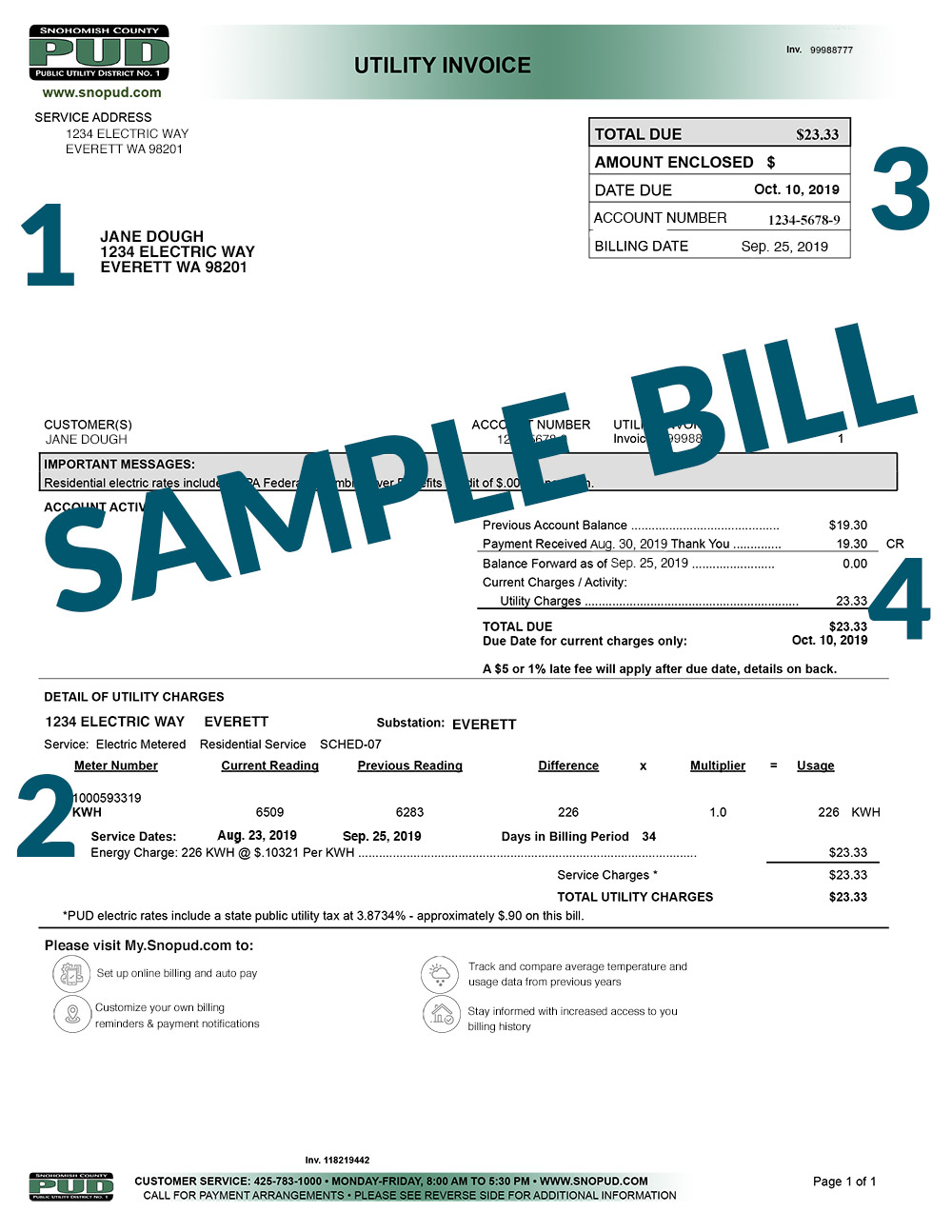

My Billing Statement Snohomish County Pud

About Snohomish County Snohomish County Wa Official Website

Graduated Real Estate Tax Reet For Snohomish County

Congrats Randi Szakaly On Your New Active Listing In Lynnwood Mls 1071717 Address 626 Logan Road Lynnwood 98036 Http Lynnwood Snohomish County Century

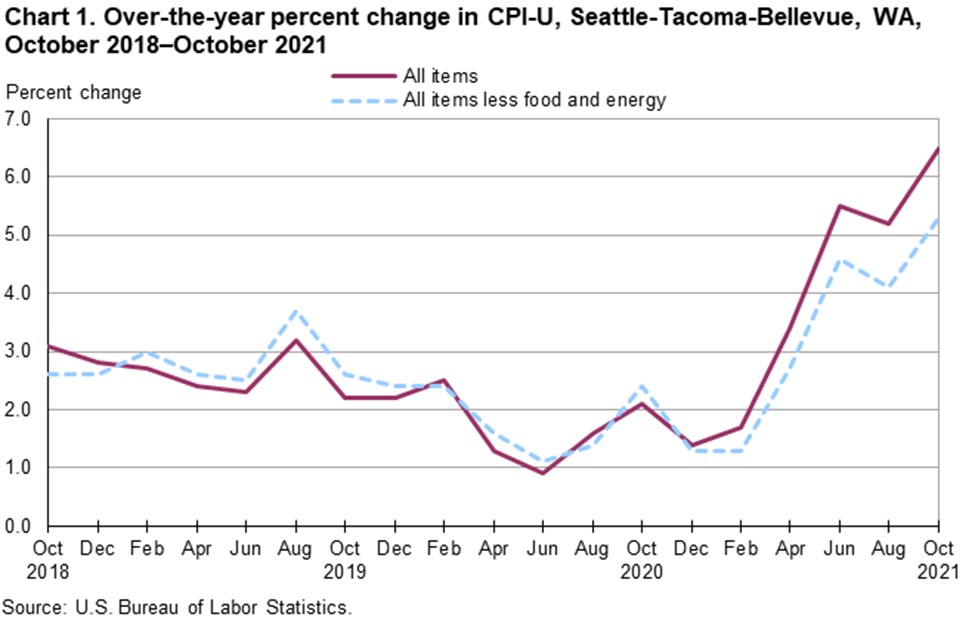

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

No Increase In Property Taxes From Snohomish County News Goskagit Com